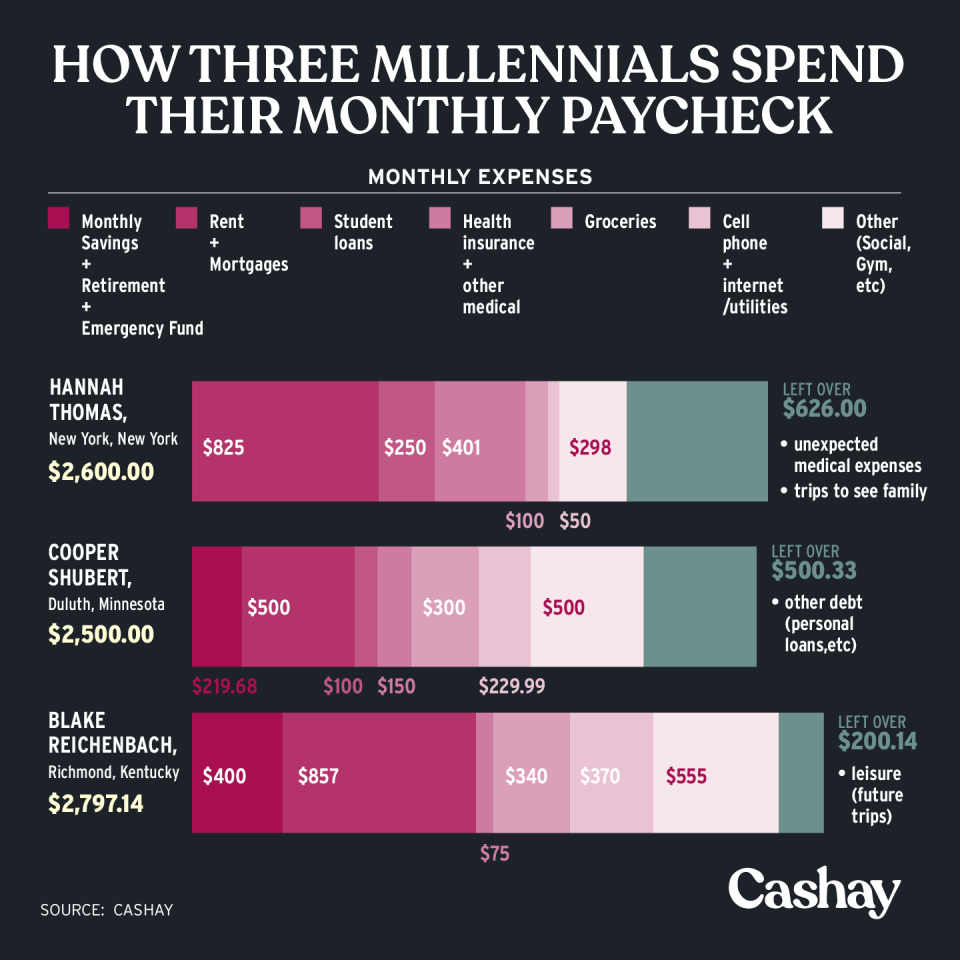

Budget breakdown: How three millennials spend and save their $50,000 salary

From the bustling streets of New York to lakefront Duluth, Minnesota and down to suburban Richmond, Kentucky, three millennials share how they manage their $50,000 salaries.

While each practices their own money-saving habits — such as traveling with one backpack overseas or skipping hangouts with friends to stretch their paychecks — they still fall short of socking away the recommended 15% to 20% of their monthly income.

High health care expenses, student loans, and other debts hinder their savings rate as well as — to a much lesser extent — their discretionary spending on food, pets, and gyms.

“The habits you build during your [20’s] will have the biggest impact on your life,” said Michael Baughman, senior financial advisor at Parsec Financial. “It’s almost impossible to catch up if you wait 12 to 15 years.”

Meet Hannah

Hannah Thomas, 27, grew up as a reduced lunch student in Ohio, so staying frugal is in her blood. She once carried a single hiking backpack to Lisbon, Amsterdam, and Ghana to avoid luggage costs.

“My one classmate introduced me as the person that just took a backpack,” said Hannah, who now lives in New York working as an international student advisor, making a $48,000 salary. “I never check in luggage and spend $60.”

Meet Cooper

In the western-most point of the Great Lakes, Cooper Shurbert, 30, helps widows, divorcees, and other women in transition manage their finances at Align Financial LLC. He makes $50,000 a year and recently took up ballroom dancing as a hobby.

“Some of the best moments are those ‘aha!’ moments when a client is very worried, but you’re able to help them and say that it’s going to be okay,” said Cooper, who lives in Duluth, Minn. “If I can’t manage my money, I can’t manage others.”

Meet Blake

Deep in horse-riding and bourbon loving Richmond, Ky., Blake Reichenbach spends his days working as a remote product expert at HubSpot. He also started a side hustle, maintaining the reviews site blakewrites.com.

A self-described “spreadsheet connoisseur,” Blake sticks to Microsoft Excel when budgeting his $55,000 salary.

“I think psychologically there’s something really effective about your being the one to recognize where your money is going,” Blake said. “I think using apps, you miss the self-reflection in what you’ve purchased.”

Budget breakdown: Housing

The biggest budget item for all three is their housing. In general, financial experts recommend spending no more than 30% of your gross income on your housing costs. Each is close to this rule, but to varying degrees.

Cooper contributes only a third of the $1,500-a-month rent on his three-bedroom house under an agreement with his partner. But, he takes care of the groceries and utilities. Still, his housing costs only account for 20% of his monthly salary.

“While Duluth is known for having a low standard of living, I would say we are on the higher end of that compared to what other places are,” Cooper said.

Blake spends just under 31% — or $857 — on his housing. But unlike the other two, he owns his split-level home totaling 2,000 square feet. He chose the location — about 90 miles from Louisville — because homes there are much cheaper. The three-bedroom house with a fenced-in backyard cost $149,900 and Blake contributed a 13% down payment from savings and an inheritance.

“As much as I prefer larger cities with plenty of amenities and things to do,” Blake said. “Moving to a smaller town that’s still within driving distance of larger cities was a big cost saver.”

Hannah spends the most on housing, contributing almost 32% of her monthly paycheck – or $825 –to rent a 4-bedroom apartment in Hamilton Heights in Manhattan. She shares it with three roommates.

Budget breakdown: Food

When it comes to food, Cooper and Blake are living a bit large, according to experts. They both spend about 12% a month on groceries, just above the recommended 10% from financial experts.

Blake could spend less, he admits. He splurges about $340 a month on food, but at least a fourth of that goes towards his dogs. He puts that spending on a rewards credit card for the points.

His two goals while grocery shopping? Shop for lean meats and items that are cheap.

“I cook most of my meals and I'm a fairly boring eater,” Blake said. “I primarily make a lot of baked chicken and mixed vegetables.”

Cooper spends a similar amount — $300 a month — on groceries, shopping at a local, higher-end store. While he often cooks Thai curries and spaghetti and meatballs, about half of the meals for him and his partner are takeout.

The most food-savvy is Hannah. She spends less than 4% of her monthly income — or about $100 — on groceries each month. She keeps dinners simple — think eggs, oatmeal, and a “crap ton of curries with drum sticks because they’re affordable.” She’s turned cooking into a hobby and blogs on Instagram with the handle @cheap_cooking_good_looking.

“I know we live in Manhattan, but come on people — I don’t need $30 of take out sushi,” she said. “I only spend $25 a week.”

Budget breakdown: Saving

The rule of thumb is to save three to six months of necessary expenses to help weather an emergency. Neither Hannah, Cooper, nor Blake have saved half of what they need.

They’re similar to the 1 in 4 Americans who have a rainy day fund, but not enough to cover three months’ worth of living expenses, according to a Bankrate survey last year.

Cooper needs $5,999, but has saved only $2,500 — 42%

Hannah needs $5,772, but has saved only $2,155 — 37%

Blake needs $7,791, but has saved only $3,150 — or 40%

Blake said while he’s been saving as much as he can toward his emergency account, he hasn’t thought much about retirement until this year.

“I probably should have been putting money aside into an IRA, but 2020 I’ll be looking at those estimates,” he said.

Cooper similarly wishes he could save more, but his credit card debt and personal loan take precedence. He currently has more than $10,000 saved in his 401k and puts away almost 9% of his monthly paycheck towards savings, retirement, and an emergency fund.

Hannah, meanwhile, makes no retirement contributions, largely because of her student loans. “I took out money from my teacher retirement fund and want to put it towards my student loans,” she said.

Budget busters

Student loans make up one-half of Hannah’s financial struggles. She owes $76,700 from graduate school.

“I pay as much as I can,” she said. “I only need to pay $250 a month so I try to put down $500.” she said.

Hannah also has to budget for health expenses, her second-largest budget item. Any left over money each – usually around $600 or a quarter of her pay – typically goes to unexpected medical expenses.

“Last December, I went completely deaf,” she said. “This situation led to unforeseen medical expenses such as audiologist visits, steroids, urgent care visits, and more.”

Cooper, who manages to have about 20% of his monthly pay left over each month, spreads it over his multiple debts, including $19,000 in student loans. He spends approximately 14% of his monthly paycheck on debt obligations.

“I try to save when I can,” he said. “Otherwise, it is used to pay off any debt that may have accumulated over the year such as student loans or credit cards and personal loans.”

Dhara is a writer for Cashay. Follow her on Twitter @dsinghx.

Read more information and tips in our Budgeting section

Read more personal finance information, news, and tips on Cashay