Rising employee premiums and deductibles in the US are 'leaving millions of families exposed'

This article was originally published on Yahoo Finance.

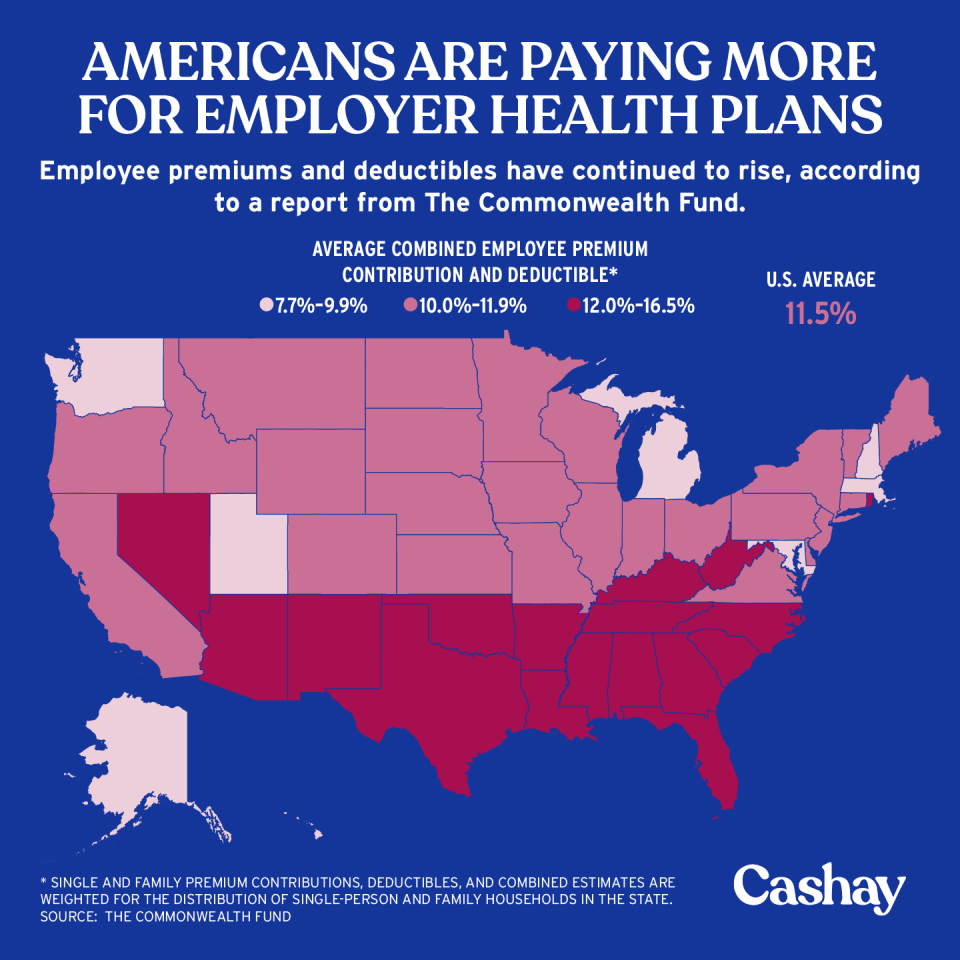

It’s no secret that health care costs continue to rise, and new research from the Commonwealth Fund (TCF) indicates that Americans are paying more for their premiums and deductibles than ever before.

The study found that in 2018, employee premiums and deductibles for both single-person and family policies rose to an average of $7,388. In nine states, the total exceeded $8,000, while the lowest rate was $5,815 in D.C.

“It shows that over the last decade, premiums and deductibles have taken up a larger share of family income across the country,” David Blumenthal, president of the Commonwealth Fund, said. “Employer health care coverage is leaving millions of families exposed to high and potentially unaffordable costs.”

The total cost of premiums and deductibles came out to 11.5% of median income in 2018, which is up from 7.8% in 2008. This varies by state across the country.

“In Mississippi, for example, people could spend more than 16% of their incomes on premiums and meeting deductibles, compared to an average cost burden of 8.4% in Massachusetts,” the report stated. “In Mississippi, combined premiums and deductibles are higher than those in Massachusetts, and Mississippi has the second-lowest median income in the country ($47,800). In contrast, median income in Massachusetts is among the nation’s highest ($81,913).”

Among the premiums by state in 2018, the average single-person plan is at a low of $5,971 in Tennessee and a high of $8,432 in Alaska. For family plans, the lowest is $17,337 in North Dakota and the highest is $22,294 in New Jersey.

“Over the last decade, U.S. median income has not kept pace of families’ premium costs in employer health plans,” Sara Collins, president at the Commonwealth Fund, told Yahoo Finance. “At the same time, deductibles in these plans have also grown faster than income, leaving many families underinsured. People across the country are not experiencing employer health insurance costs equally. The most cost-burdened families are in the South.”

‘At what point does it become a matter of public policy’?

The report is in line with previous findings from TCF estimating that 23.6 million Americans with employer coverage had high premium contributions, high out-of-pocket costs, or both. Those with premiums that exceed 9.86% of income are eligible for marketplace subsidies, which according to TCF, triggers a federal tax penalty for their employers. However, it’s only applicable to single-person policies.

“In many states, even though premium costs take up a large share of people’s income, many people are not getting insurance that offers them good cost protection,” Collins said. “This is because many deductibles are also high. Over the decade, deductibles grew both in proliferation and size.”

Hawaii and D.C. had the lowest average deductibles at $1,300 in 2018, while Maine had the highest at more than $2,400.

“Research has indicated that high deductibles can act as a financial barrier to care, discouraging people with modest incomes from getting needed services and leaving them possibly underinsured,” Collins said.

The rising cost issue could be related to the repeal of the individual mandate penalty by the Trump administration in 2017. At the time this occurred, the Congressional Budget Office (CBO) estimated that “average premiums in the nongroup market would increase by about 10% in most years of the decade (with no changes in the ages of people purchasing insurance accounted for) relative to CBO’s baseline projections.” According to CBO, this is because “healthier people would be less likely to obtain insurance” and because the premium increase would dissuade others from buying insurance.

“The question is: If people are facing premium costs that high, at which point do they decide not to continue having insurance or a selection of insurance in [their] plans?” Collins said. “At what point does it become a matter of public policy to think about addressing that affordability issue?”

Read more information and tips in our Healthcare section

Read more personal finance information, news, and tips on Cashay