Here's why you need a financial date night

Jill Hitchcock is the senior executive vice president responsible for the U.S. private client group at Fisher Investments, a fee-only investment adviser.

Last month, I wrote about the importance of naming your family’s Chief Financial Officer (CFO)—someone designated to manage the family budget and finances. If you’ve just been asked (or “voluntold”) to be your family’s CFO, you should dedicate your first 90 days on the job to identifying and planning for your long-term financial goals.

You’ve probably seen countless budgeting articles promising early retirement if you just resist that $4 coffee every morning. Look, I agree that being cost-conscious is smart—that’s why I’ve packed my lunch for over 20 years! But obsessing over small, everyday expenses isn’t really going to move the needle over the long term—and you’ll just drive yourself and your family crazy along the way.

Instead, I recommend you start by scheduling a date night with your partner to discuss your long-term financial goals and how you can work toward them now.

Plan your financial date night

For your date night, block out a time when you can focus and be really thoughtful about what’s most important in your financial future. Set the stage: You need a quiet spot to work, some blank pieces of paper and—at least for me—a bottle of wine.

Think of this as a brainstorming meeting, not a budgeting meeting. No spreadsheets required! If you’re one of those people who religiously tracks your expenses down to the penny, more power to you! But I’d rather poke out my eyeballs. So, I just make sure I know three key things: roughly how much money I make and spend each month, my long-term financial goals, and how to make progress toward those goals now.

Draw your timeline

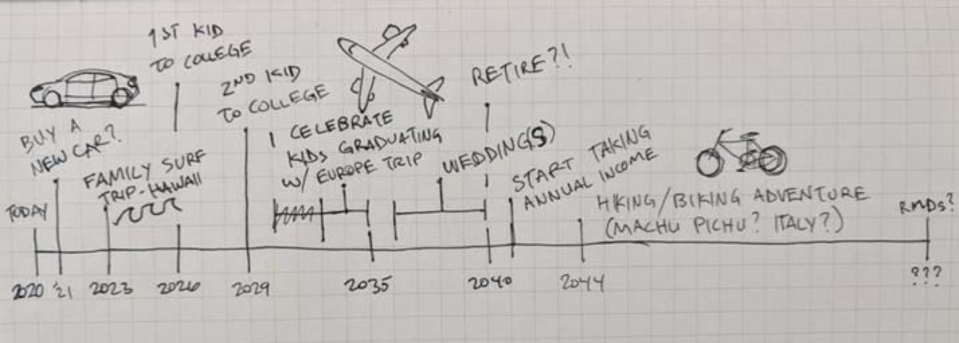

Start the meeting by sketching out a timeline of the next 20 to 30 years on a blank piece of paper and filling in your major financial milestones. This is where it gets fun, because you basically end up with a wish list for your future.

Include things like buying a home, paying for college and/or weddings, taking major trips, making big purchases and, eventually, retiring. Of course a lot can change over time and you aren’t trying to nail every detail. It should look something like this:

It’s also a great exercise for getting on the same page as your partner. I recommend doing your timelines individually and then comparing to see how aligned you are.

Do you have similar ideas on major purchases, when you want to retire and whether you’re going to pay for things like your kids’ weddings and college tuition? You aren’t looking for perfect alignment, but if you’re majorly divergent—like you want to retire at 50 and your partner was thinking 65—you may want to sort that out together. (I told you you’d want that bottle of wine!)

When creating your long-term timeline, you’ll probably have to ask yourself some tough questions like: “How much money will I need in retirement?” and “How long do I need my money to last?” Be prepared to think about things like your health status and family history. Your life expectancy may be much longer than you think and you should also consider your partner’s life expectancy. If you underestimate how long you need your money to last, you could face the nightmarish scenario of running out of money in retirement.

For now, just make your most-educated guess. I’ll provide more tips on retirement planning soon.

Use your timeline to inform your savings decisions

Once you have your timeline—even if it’s chicken scratch for now—you can start to talk some numbers.

First, estimate your inflows. What’s your income? For most people, that should be relatively easy. Then, move to outflows (less fun!). Do you know how much you’re spending on a monthly or quarterly basis? Remember, your goal isn’t to detail every $4 latte, but to have a realistic estimate of how much you regularly spend.

Now, assess: Are your inflows higher than your outflows? If not, it’s time to look at how you can increase your inflows, reduce your outflows, or both. If your inflows are higher, toast yourself! But also check whether you’re saving enough to meet the milestones on your timeline.

I set annual savings goals, but you might prefer to do it monthly or quarterly. These savings goals will help you continually save and put money toward your future milestones. And if you have trouble saving, take advantage of the technologies that help you save automatically.

For example, there are apps that round up your everyday purchases and then deposit the extra money into your investing account. So if you do spend $3.78 on coffee, the app will “round up” to $4.00 and deposit the extra $0.22 into your investing account.

Once you’ve identified your long-term goals and set your target savings amount, the math is pretty easy. You can apply a realistic rate of return for your savings and investments (the key here is “realistic!”) to see whether you’re on track to meet the goals on your timeline.

Don’t be daunted by the misconception that you have to build a complex spreadsheet—a blank piece of paper with doodles is all you’re going for right now. If you can get started planning this way, you’re already ahead of most people. And it may help you feel a little less guilty on those mornings you really need that $4 latte.

Read more information and tips in our Family section