Can you discharge student loans? Here's how one man did in a watershed bankruptcy case

This article was originally published on Yahoo Finance.

For nearly 15 years, U.S. Navy veteran Kevin Rosenberg owed six figures in student loans.

But on January 7, 2020, a New York judge ruled that the $221,385.49 in student loan debt owed by Rosenberg as of November 2019 was dischargeable under chapter 7 bankruptcy.

“I have a chance now to have a life,” the 46-year-old Rosenberg told Yahoo Finance in an interview.

A bankruptcy expert told Yahoo Finance that Rosenberg’s case is a watershed in that it dispels the notion that student loans were not dischargeable in bankruptcy.

“What I found most fascinating, and I think heartening, is the very strong language that the judge used to call out on what she calls this quasi-mythic status of student loan non-dischargeability,” Jason Iuliano, an assistant professor of law at Villanova University and an expert on bankruptcy, told Yahoo Finance. “I've never seen it put quite so pointedly before in a judicial opinion like that.”

After more than a decade of going through the student loan system — making on-time payments, following up with loan servicers, keeping up with the paperwork — he was finally free of his student debt.

“I can't give anybody legal advice,” the former naval officer stressed before sharing his story.

‘Having this debt, it would ruin relationships for me’

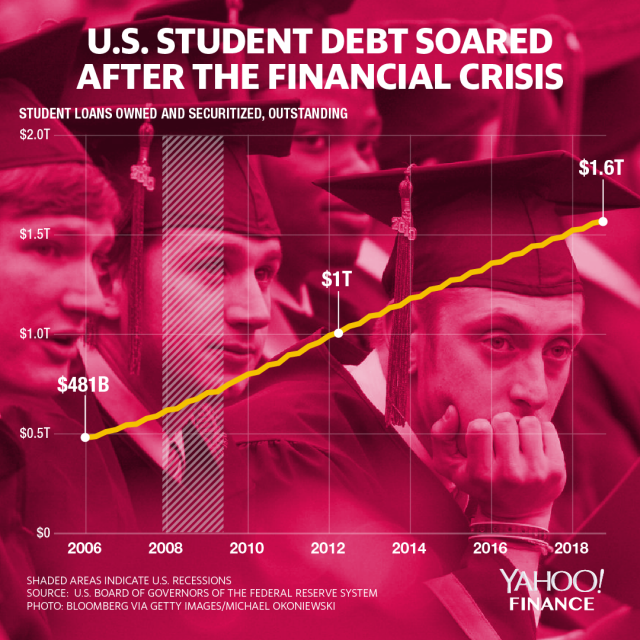

American borrowers hold more than $1.6 trillion in outstanding student loans as of November 2019, according to data compiled by the Federal Reserve Bank of St. Louis.

That number has been rising steadily over the past few years and has reached an inflection point: From presidential candidates proposing cancellation of student debt — Senator Elizabeth Warren (D-MA) pitched a plan that makes it easier to declare bankruptcy for student loans — to companies offering to help pay off their employees’ student debt, addressing the issue has become a priority.

But politics wasn’t on Rosenberg’s mind.

His journey with student debt began in 1993, according to the lawsuit, when he took out student loans for his undergraduate degree. He kept up healthy financial habits, repaying his loans faithfully, until he served in the United States Navy on active duty for five years. After completing his tour of duty, he started law school at Cardozo in New York, for which he took out additional student loans.

After he graduated in 2004, Rosenberg consolidated his loans and held a little more than $116,000 in student debt as of April 2005. That number ballooned to about $221,000 over the next 14 years.

He then passed the bar exam in New York and New Jersey and joined a law firm before deciding that a law career wasn’t for him.

“First of all, I realized the whole job is sitting in the office by yourself,” Rosenberg said. “You can't be creative at all, but also that you either help people out or you make a good living — you can't do both. And I kind of had a problem with that.”

Rosenberg left the law firm to pursue various entrepreneurial pursuits, the latest of which was an online equipment-rental and guide service featured in a New York Times article. But a combination of events over the years — the Great Recession, the death of retail, as well as personal issues — led to some setbacks, which resulted in periods of uncertainty and financial problems compounded by his student debt.

“All along, having this debt, it would ruin relationships for me. ... it just affects everything in your life,” he said. “It always pissed me off that people at corporations who just negligently screw up, they just take chances they shouldn't... They get out of bankruptcy, no problem, and the executives get golden parachutes.”

He continued: “Whereas with someone who just tries to get an education and better themselves… There's this argument that you shouldn't be allowed to discharge your debt, you shouldn't be able to declare bankruptcy. And it’s just ridiculous, it's just really insane, it's almost a reverse standard. And I just kind of felt like an indentured servant.”

Nevertheless, Rosenberg said he worked seven days a week, pulling off 10 to 12 hours a day for years, “trying to make this work.” But after years of struggling with the debt, he decided to take the plunge and file for bankruptcy under chapter 7 to tackle his debt.

“This wasn't an easy decision,” he stressed. And despite knowing from research how high the bar was to have the debt erased, “it was kind of like, ‘What do I have to lose?’” he said. “I can't afford to pay the loans back. I can barely afford to live.”

‘Maybe with this myth shattered, they'll lower what they charge’

Rosenberg began by looking into the different tests that judges use to identify whether a debtor is deserving of a discharge, identifying the Brunner test as an important one. He also decided to pursue the case as his own legal counsel.

“When I was looking at hiring a lawyer to do it for me, I was getting quotes of around $40,000 because the lawyers see it as this really hard, arduous process,” he explained. “Maybe with this myth shattered, they'll lower what they charge. They were looking at it like it's an endless thing. And it's going to be lots of work and appeals and all this stuff.”

Rosenberg filed for bankruptcy under chapter 7 in 2018. He also filed an adversary proceeding, which is essentially a civil lawsuit, against the New York State Higher Education Services Corporation. He said he was called to court five or six times for hearings on top of a deposition and an expert witness interview. Documents were produced and read. And both sides filed a summary judgement.

On January 7, 2020, Chief U.S. Bankruptcy Judge Cecelia G. Morris made her decision: Rosenberg’s summary judgment asking the court to declare his student debt dischargeable was granted.

“The news today leaves me with a feeling of relief, not celebration,” he wrote in a statement. “I’m thankful that I get to recover from a crushing financial blow and have a chance to get up, dust myself off, and keep going.”

Rosenberg told Yahoo Finance that the day after the decision, that “it also kind of incensed me that student loans are treated differently than other debts, especially given the bailout of corporations ... and the housing bubble.”

Because at the end of the day, the student loan system was “usury — plain and simple,” he stated. “These are not good actors here. They're not acting in good faith... It really is predatory lending in its classic sense.”

‘This Court will not participate in perpetuating these myths’

Judge Morris, who applied the Brunner test to determine if student loans have caused the borrower to suffer undue hardship, which then decides if their debt will be discharged in bankruptcy, noted that the test was “fairly straight-forward and simple” for Rosenberg.

The Brunner test requires three requirements to be met:

Debtor cannot maintain, based on their current income and expenses, a “minimal” standard of living for themselves and their dependents if forced to repay their loans

Additional circumstances exist indicating that this situation is likely to persist for a significant portion of the repayment period of the student loans

Debtor has made good faith efforts to repay their student loans

In the ruling, the judge noted that Rosenberg had been out of school and struggling with student debt for years. She ruled that given all the facts presented, Rosenberg satisfied the requirements of the Brunner test: He had far more expenses than income (resulting in negative earnings each month), had no money available to repay his student debt over time, and “did not sit back for 20 years but made a good faith effort to repay his” student loans.

“For the foregoing reasons, Petitioner has satisfied the Brunner test,” Judge Morris concluded. “Based on the foregoing, it is hereby ORDERED that Student Loan imposes an undue hardship on the Petitioner and is discharged.”

Most people believe that student debt is not dischargeable in bankruptcy because borrowers needed to clear an extremely high bar of proving they were suffering under previous interpretations of the Brunner test.

“Over the past 32 years, many cases have pinned on Brunner punitive standards,” Morris wrote, adding that judges sometimes required proof of “hopelessness” — a far more onerous standard than proving hardship. These interpretations were “applied and reapplied so frequently” and have “become a quasi-standard of mythic proportions soo much so that most people… believe it impossible to discharge student loans,” the judge stated. “This Court will not participate in perpetuating these myths… Rather, this Court will apply the Brunner test as it was originally intended.”

Iuliano, the bankruptcy expert, highlighted the myth-busting aspect of the ruling.

“The judge is so directly calling out this myth of non-dischargeability and saying: 'Hey everyone, stop and listen, the test is actually much easier than what everyone out there thinks,’” Iuliano explained. “And she's pointedly talking to the bankruptcy bar and saying: ‘You think it can't be discharged, but it actually can.’ There’s a very direct call there for them to represent their clients differently.”

Tips for other student loan borrowers

Rosenberg, who emphasized that what worked for him may not work with everyone else, also shared a few notes on how he went through the process:

Bankruptcy isn’t supposed to be a go-to solution to get rid of student debt

“Try everything you can to avoid bankruptcy,” Rosenberg stressed. “I don't want the lesson of my situation to be [that] if you file for bankruptcy, you can get rid of all that debt, even when you can afford it. It shouldn't be like that. I don't consider it a windfall. I have a chance now to have a life, that's all.”

Hire a lawyer to file the initial documents or ask for help from a nonprofit

Rosenberg advised people to seek a lawyer when filing for chapter 7 bankruptcy, as it involves paperwork. He added that it was possible to do it by themselves, though it may be easier through an attorney. A nonprofit may do the same for reduced or no fees.

Do a ton of research on what exactly to say in an adversary proceeding and see if the Bruner test applies to you

The big X factor Rosenberg’s case had was that he filed an adversary proceeding.

“Each year there are about 250,000 student loan debtors who file bankruptcy,” Iuliano said. “But then each year there's only about 400 to 500… who actually file the adversary proceeding, which is where they go before the judge and say: ‘Look at my case and make a determination’” about discharging the debt.

Why do so few people file an adversary proceeding then? Simply put, it’s just too expensive to do it.

Speaking in ballpark figures, “not only do they need a $1,500 chapter 7 fee, but if you want the adversary proceeding, you have to come up with ... [$5,000] to $10,000 up front before the case is filed for your attorney,” Iuliano explained. “And these debtors are in bankruptcy, so they don't have a lot of liquid assets they can tap to come up with five or $10,000.”

Understand your loans. Private loans are treated differently from student loans.

Finally, Rosenberg advised borrowers to understand what kind of loans they had since federal loans are treated differently from private loans.

In any case, he added, think hard before embarking on this process.

“Bankruptcy is a humiliating process,” he stressed. “No one wants to go through bankruptcy. There's nothing good about it.”

A new understanding of discharging student debt

In the end, Rosenberg’s case will have implications for others seeking to argue for the discharge of their student loans through bankruptcy.

“There's such a pervasive belief that so many people hold off on filing, but I think that's actually the wrong attitude to take,” Iuliano contended. “There's a lot of scholarly literature out there that shows people wait too long precisely for this concern — that they feel like it's a moral failing, where they feel a shame to file — and so they wait until beyond the point when bankruptcy attorneys could be most helpful to them.”

Echoing Rosenberg, Iuliano noted that “corporations declare bankruptcy all the time and no one wags a finger at them and says they’re ethically suspect for doing that.”

Going forward, Iuliano asserted, borrowers should view bankruptcy “more as a legal means for debt relief that's out there for people who really need it.”