What is a recession? What you need to know

At a glance:

What is a recession?

What causes a recession?

What happens during a recession?

How should I prepare my personal finances for a recession?

How should I prepare my career for a recession?

How is a recession different from depression?

How long will this recession last?

Who benefits in a recession?

If there was no pandemic, would there still have been a recession in 2020?

It’s official. The country fell into a recession.

Economists speculated for months about the declining health of the economy as COVID-19 spread throughout the country and shuttered businesses and retailers, stalled spending, and spurred massive layoffs.

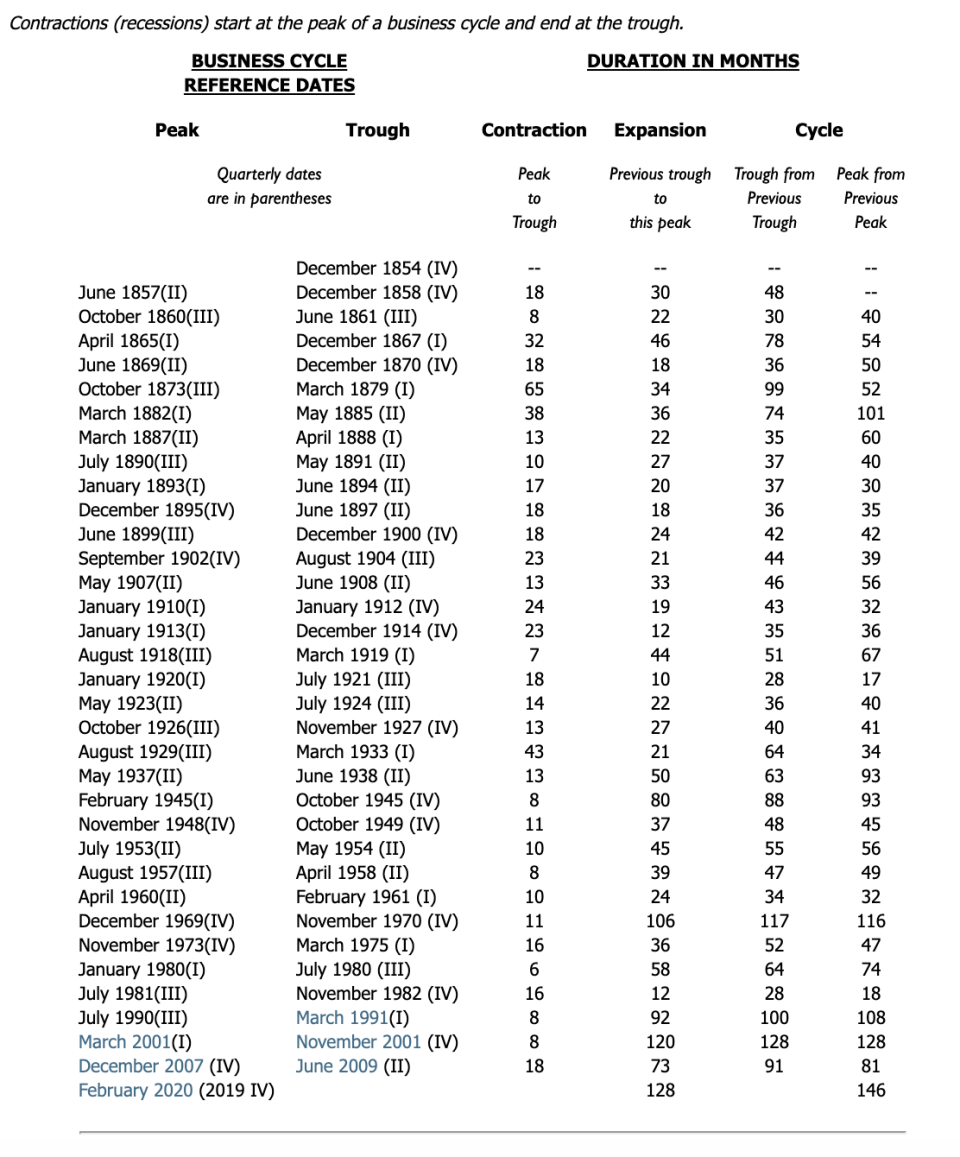

The National Bureau of Economic Research (NBER) gave the official word that the U.S. economy fell into a recession in February. The call signifies the end of the longest recorded period of economic expansion since 1854 at 128 months.

It might come as a surprise to many that the recession began in February, the month predating the unprecedented measures imposed to mitigate the pandemic. However, the committee pointed to February as the peak of the business cycle, when the expansion ended and the recession began. In other words, February is when the economy peaked and March is when activity took a turn.

Here’s what else you need to know about recessions.

What is a recession?

A recession is loosely defined as a period when the gross domestic product (GDP) — or total dollar value of all goods and services produced in a given country — falls for two consecutive quarters.

The NBER, a private nonprofit of economists, is the organization that formally determines both economic expansions and recessions, and uses more measures than just GDP to define a recession. Here’s its explanation:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.

In simplest terms, a recession is an ongoing economic slump that includes flatlining incomes, employment, industrial production and retail sales, too. Often, the NBER retroactively declares a recession as it did with the Great Recession. It deemed it a recession in November 2008, 11 months after it started.

What causes a recession?

Typically when consumer spending, real estate, and manufacturing slows during a high-interest period, that’s considered a recipe for a recession.

The last two recessions in 2001 and 2007 started after asset bubbles burst in technology stocks and housing, respectively. But the Great Recession spiraled even further, becoming a financial crisis when the supply of credit was choked off.

The economy also runs in cycles, according to Allen Katz, a New York-based certified financial planner

“There are ups and downs that for the most part can't be controlled,” said Allen Katz. “Government policies can change the magnitude, but can't stop the cycles.”

The economy now faces the consequences of a global health crisis that requires consumers to stay home — thus limiting their spending — and businesses to close down temporarily to stem the spread of the disease.

This recession is something of an anomaly, according to Tim Duy, an economics professor at the University of Oregon. Calling it “self-inflicted,” the government took unprecedented measures to shut down the economy and told people, mainly service workers, to stop coming to work.

In the absence of other drivers or markers, Duy pegs this period of contraction to COVID-19. “I think it really was entirely the pandemic that drove the downturn,” he said.

What happens during a recession?

Recessions are so routine that since 1920, Americans have weathered 17, each lasting anywhere from six to 42 months, according to the NBER.

That gives us enough historical data to spot recession trends and hallmarks. Recessions usually share certain characteristics, and many have a domino effect as the economy contracts:

Unemployment spikes

Capital expenditures — the buildings, equipment or land purchased by a business or corporation — sink

Consumer spending tightens

Business activity tanks

Bank credit and loans are harder to come by, particularly for small business owners and entrepreneurs

Real estate values and sales fall

Interest rates fall

Several of these factors are occurring now. The Federal Reserve in March slashed its benchmark federal funds rate to between 0% and 0.25%. The interest rates on many business and consumer loans are tied to this rate.

Consumer spending fell by a record 13.6% in April. The unemployment rate spiked to 14.7% in April, and recovered a bit in May at 13.3%. Many businesses, especially retailers, have filed for bankruptcy protection. Lenders also have imposed stricter qualification requirements, lowered credit limits, and issued fewer credit cards.

How should I prepare my finances for a recession?

There’s nothing you can do to prevent an economic contraction, but you can help your finances weather a recession by taking the following steps:

Pay down credit cards: High-interest credit cards are like quicksand. Avoid falling in the trap of paying expensive interest (plus associated fees) and start paying down your balance, especially if you’re worried about a tough economy.

Two well-worn paths of debt repayment are snowball and avalanche methods. Snowball ranks all of your balances from lowest to highest and then focuses extra payments to the lowest balance loan. The avalanche is similar, but extra payments are made on the loan for the highest interest rate first.

Sock away money: If you don’t have an emergency fund, building one is a good place to start before or during a potential recession. If you can avoid it, try not to rely on high-interest credit cards to carry you during your temporary unemployment.

Should you or a member of your household get laid off or have your pay or hours scaled back, that’s when it’s time to dip into your emergency savings account to cover necessary expenses. Conventional wisdom dictates to have three to six months' worth of money to cover living expenses while you’re looking for work.

“If you have trouble saving, then automate as much as possible,” said Aaron Clarke, a Virginia-based financial advisor “Remove the temptation to spend money you should be saving for a rainy day. Set up auto transfers so that you have no choice but to spend less by deferring your income to savings before you even get a chance to spend it.”

Evaluate your budget: This is the time look over your budget and identify what is essential (rent, utilities, groceries) and what is nice to have (dining out, concerts, new clothing). If you need to boost your income, cut out those nice-to-have’s first.

Reconsider certain recurring subscriptions as well. You can cancel or freeze for a month optional utilities such as cable TV or streaming services subscriptions. The same also goes for gym memberships.

Sell unwanted possessions: Another way to boost your cash reserves is to get rid of the things you don’t need — for money. Forgo the hassle of organizing a garage sale and use marketplace sites like LetGo or Craigslist to post your electronics or furniture or jewelry for free. Communicate directly with the buyer and agree to a pick-up location. You’ll declutter your home and make some extra cash.

Access sources of cash: It’s always better to have more access to potential funds during uncertain times. If you’re a homeowner, look into opening a home equity line of credit that you can tap if needed. Ask banks to increase the credit limits on your existing credit cards.

If you expect to get a tax refund — but haven’t filed your taxes yet — it’s time to get cranking. The average refund is around $3,000, which can go a long way.

Check out your options and the rules for borrowing against your retirement savings. The CARES Act has also made it easier to withdraw from your 401(k) early without facing the usual penalties.

Communicate with creditors: Your creditors are surprisingly willing and able to work with you and can arrange concessions like reduced payments and interest rates. At this time, many are offering deferred payments, forbearance, and waivers of penalties or late fees. This is not just a strategy for your banks and lenders; you should also reach out to your utility providers and cell phone company if you’re experiencing a hardship.

Know your resources: Before seeking a loan from a banking institution or credit union, seek out nonprofits or government assistance programs that can help offset the costs of your groceries, utilities, and clothing. This includes the Supplemental Nutrition Assistance Program (SNAP), the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), and unemployment benefits.

Conservatively borrow: Personal loans are attractive right now because they generally have lower rates than credit cards, but not all are created equal. Stick to banks or credit unions. If you have excellent credit, it might make more sense to open a zero-percent introductory rate credit card for necessary expenses.

How should I prepare my career for a recession?

Since mid-March, more than 40 million Americans have applied for unemployment benefits. In April, the unemployment rate soared to 14.7%, the highest since the Great Depression, before backing down to 13.3% in May.

If you are laid off or furloughed, it’s important to apply for unemployment benefits, understand your health insurance options, negotiate severance pay if possible, among other considerations. Cashay offers a guide on what to do when you lose your job. There are government assistance programs for essentials like food and discounted utilities.

If you’ve been spared from the swaths of layoffs, it may make sense to put any job changes on hold.

“Try not to make a career move right before an economic slowdown,” Clarke said. “It’s never good to be the new kid on the block when your employer may become financially strained.”

Take the time to shadow and learn from your colleagues. When budgets get slashed, duplicative or overlapping roles will be eliminated and those still employed will have to carry a heavier load. Amass all the knowledge and information you can about your industry or company and complementary jobs to show your employer that you’re a valuable asset.

If you’re venturing out into the professional world for the first time, you are entering the job market when unemployment is at its highest. Just mere months ago, unemployment was at nearly a record low.

Duy tells his students that networking and flexibility will serve them well. The career path you trained and studied for might not be expanding right now.

“If you're married to a particular firm, sector, or especially location, that might create some problems for you,” Duy said. “It just might be that if you need a job now you might have to be more flexible on what's available.”

How is a recession different from depression?

President Harry Truman, President Franklin Roosevelt’s vice president and eventual successor, deftly distinguished the two: “It's a recession when your neighbor loses his job; it's a depression when you lose yours.”

While there’s no standard definition for a depression, economists generally agree that a depression is considered a more severe and extended recession.

For instance, during the Great Depression which lasted from 1929 to 1939, the unemployment rate peaked at 24.9% in 1933. During the Great Recession, which lasted from 2007 to 2009, the unemployment rate topped at 9.3% in 2009, according to the Bureau of Labor Statistics.

Fortunately, American economists have learned from the past and regulations have been enacted to help prevent future depressions. Katz pointed out “there were less checks and balances” in the 1920s and since then, “many laws were enacted to try to avoid this.”

“Each downturn since, in comparison, has been less damaging and has taken less time to recover from,” he said.

The duration of the downturn also plays a major role in separating a recession from a depression. Even if this is a short period of contraction, even if it’s unprecedentedly sharp, it’s still not a depression, Duy said.

How long will this recession last?

The NBER has made a longstanding policy of not commenting or speculating when a current recession will end, so don’t count on hearing any forecast from the organization.

Economists like Duy speculated if the recession is already over. April’s lows might be the worst for the economy. As restrictions lift and many states lay out phases for the reopening of gyms, salons, restaurants, and movie theaters, millions will return to work and help the economy rebound.

How long it will take to rebound remains a question mark. Recovery is another question because the “depths of that initial hit was so severe” that returning to the country’s “past peaks of activity” and “past lows of unemployment” could take some time, Duy said.

How quickly that happens is a better marker for whether the economy is in a technical recession is how strong is the expansion going to be after the initial phase of recovery.

“We basically flipped off a light switch,” he said. “So we're trying to turn back on that light switch, which unfortunately is a dimmer switch and we'll turn it up slowly.”

Who benefits in a recession?

Although its effects can be long-lasting, a recession doesn’t have to be a financial death sentence and a silver lining does exist.

Americans learn to live with less in leaner times and personal savings generally rise. The pandemic has forced the country to slow down and revel in the things that money cannot buy, like the support of family or connectivity with friends.

Tougher economic times mean weakened stock and housing markets but can create windows of buying opportunities for first-time investors or homebuyers, if you have the money to invest. Markets not only rebound, but they can reach pre-recession highs.

Depending on your distance to retirement, it’s important to not get skittish by the market’s volatility.

“If you invested in the S&P 500 in October of 2007 (a pretty bad time to invest), as long as you remained invested, your money would have grown over 160% or over 8% per year,” said Mark Beaver, an Ohio-based certified financial planner.

If there was no pandemic, would there still have been a recession in 2020?

Probably not. The length of the last business cycle, while one for the history books, doesn’t necessarily mean that the country was primed or due for a recession.

Duy said that, among his peers, the general consensus for 2020 was that it wasn’t going to be the best year economically, but a recession wasn’t on the horizon. Unlike prior recessions that could be forecasted like the housing or tech bubbles, Duy said “there was nothing ‘wrong’ about the economy that would have indicated a space for a massive contraction.”

Stephanie is a reporter for Yahoo Money and Cashay, a new personal finance website. She can be reached at stephanie.asymkos@yahoofinance.com. Follow her on Twitter @SJAsymkos.

Read more information and tips in our Travel section