What to do if you’re denied a new credit card

With the economic effects of the pandemic unfolding and millions of Americans left unemployed, credit card issuers are mitigating their risks by pulling back on issuing new credit cards and cutting credit limits.

Only 2.3 new cards were opened per 100 people with credit reports from March 15 to April 15, compared with 8.8 new cards during the same time in 2019, according to a new report by CompareCards.com of 100,000 anonymized credit reports.

While one reason is because Americans are applying for fewer cards, to a larger extent, it’s because banks are more stingy about issuing to new consumers. Some credit card issuers, such as Discover Financial Services, have publicly said they’re offering fewer cards to new customers since the pandemic started.

While you have a higher chance of being denied a new credit card versus a year ago, there are a three steps you can take that can help you get a card, even if you get rejected first.

Ask to be reconsidered

If you’ve been rejected for a credit card, the lender generally has to let you know what the reason is, including which credit bureau it used to pull your credit report to make that decision. You can get a free copy of that report and check if there are any errors that would lead to your rejection.

“Lenders have dedicated phone lines called reconsideration lines where you can call them and ask them to reconsider the fact that you've been rejected for that card,” said Matt Schulz, chief industry analyst at CompareCards.

If you find an error in your report, you should definitely request reconsideration, according to Schulz. But even if there are no errors, it doesn’t hurt to call and ask the bank to reconsider your application.

Get a secured credit card

If the reconsideration was unsuccessful, opening a secured line of credit may be a good alternative for you. While not as attractive as unsecured credit cards, they’re easier to attain.

“You have to put some money down to set that credit limit. That may be a difficult thing if you've lost your job,” Schulz said. “But if you do have a little bit of money to establish that credit, and that would be another way to help you extend that budget a little bit.”

Secured credit cards are generally available because the risk on those cards for banks is minimal due to the initial upfront security deposit, which can range from $250 to $3,000, depending on the card. The deposit you put down typically equals the monthly credit limit you’re given. In some cases, you can upgrade the card to a regular credit card after a year or so making on-time payments to the issuer.

Work on your credit score

Improving your credit score will give you a better chance of qualifying for your next new credit card. One quick way to do that is by looking through your credit report from Equifax, Experian, and TransUnion and have any errors fixed. The most important errors to correct are those that inaccurately portray your payment history, especially if your record has been spotless.

“Lots of credit reports out there have errors on them. They can hold your credit score down through no doing of your own,” Schulz said. “Taking a look at your credit report can be a really good idea, whether you're planning on applying for credit or not anytime soon.”

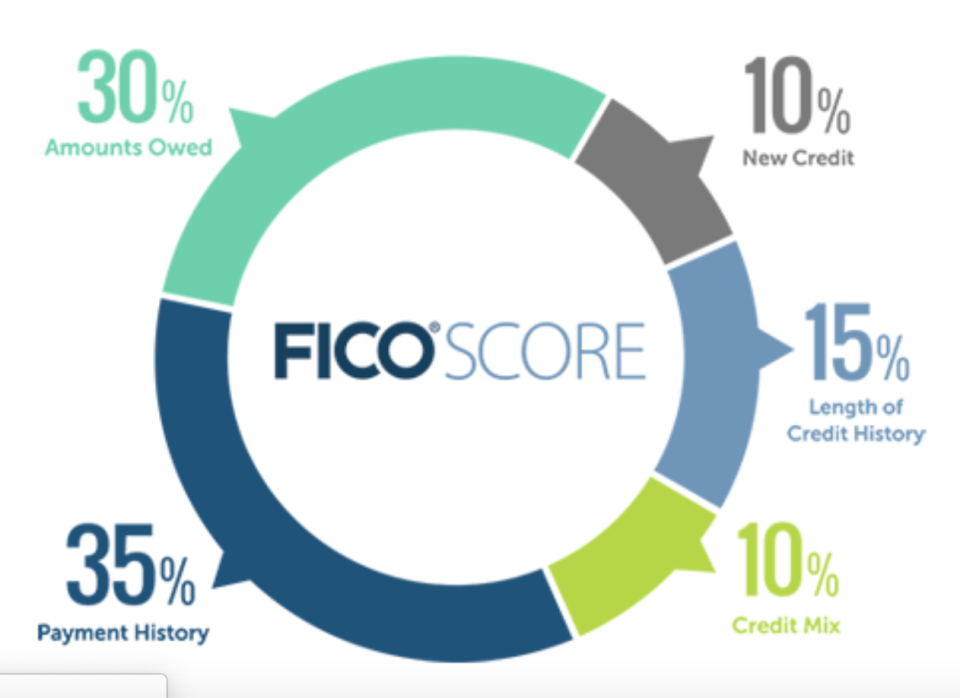

You can also request an increase in the credit line on your existing credit cards. This can help improve your credit score by lowering the percentage of available credit that you use, called credit utilization, which makes up 30% of your FICO credit score.

While getting a credit limit increase is less likely than before pandemic, this shouldn’t discourage you from asking, especially if you’ve been a responsible cardholder.

Denitsa is a reporter for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more information and tips in our Credit cards section

Read more personal finance information, news, and tips on Cashay