Why only 1 in 4 young U.S. adults are financially independent from their parents

This article was originally published on Yahoo Money.

Younger Americans are taking longer to be financially independent from their parents versus their counterparts four decades ago, according to a study.

Only 1 in 4 young adults last year were financially on their own by 22 – the age most Americans believe they should reach this milestone – down from 1 in 3 in 1980, the Pew Research Center recently found.

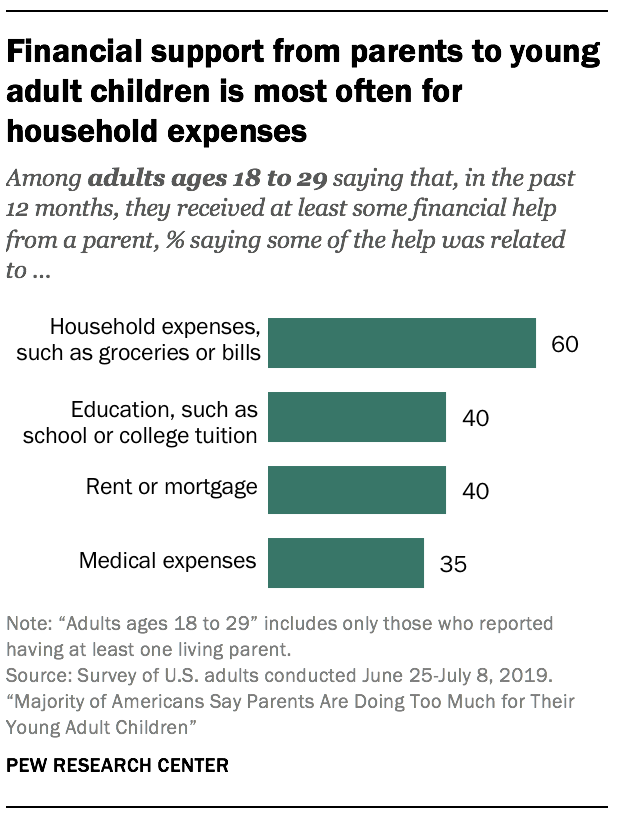

Many still receive money from their parents to pay for bills, groceries, rent and tuition, while others live at home. Young adults are considered financially independent if their income is 150% or more of the poverty level for a one-person household. In 2018, that threshold was $19,128.

“More young people are going to college these days, and that may slow their entry into the workforce and cause some to remain financially dependent on their parents,” said Kim Parker, Pew’s director of social trends research. “Other factors include rising college debt and rising housing costs.”

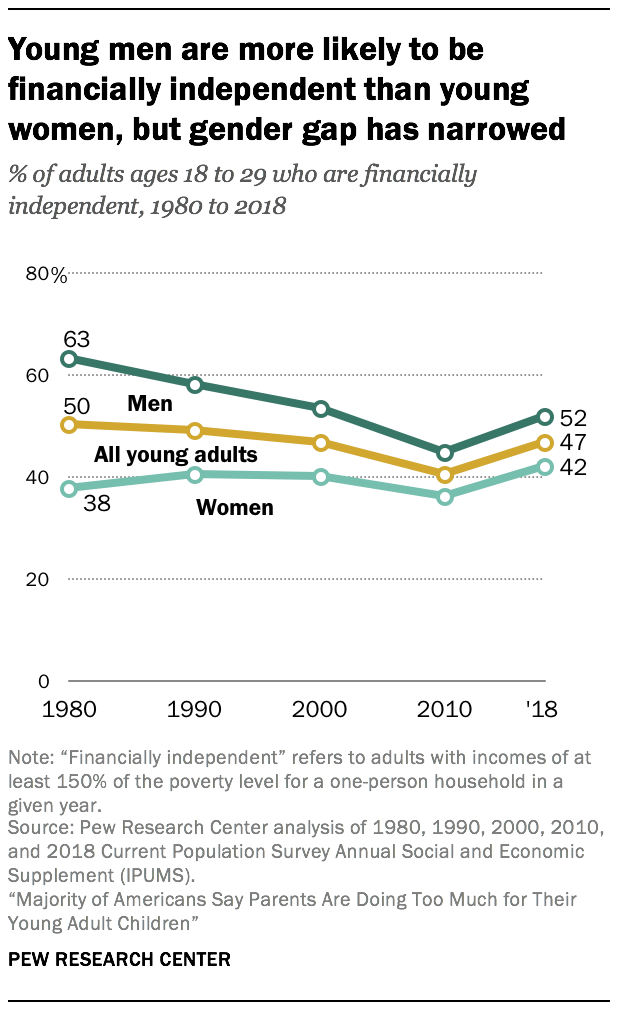

By the time they approach their 30th birthdays, young adults are nearly on track financially as previous generations, though. Last year, 47% of all young adults between 18 and 29 were financially independent, only slightly less than 50% in 1980.

Reasons for delayed independence

Young adults now are taking more time to manage their finances because they’re staying in school longer and getting married later. More live in their parents’ homes in their 20s and early 30s compared with earlier generations

But they’re not necessarily poor money managers, said Erika Safran, a financial advisor at Safran Wealth Advisors.

“I don't see young people being irresponsible with credit cards, or going out and buying things that they can't afford,” she said. “I see some circumstances that will prevent them from ever achieving certain goals, like the opportunity to buy a house.”

For example, some attended expensive colleges and, as a result, have piles of unaffordable student loans, making them more dependent on their parents, Safran said.

Others took jobs after college that didn’t pay enough to support all of their living expenses.

“In the aftermath of the Great Recession, the job market was particularly challenging for young adults,” Parker said.

Financial independence by gender

There’s a gender imbalance, too, when it comes to financial independence from parents. While more men have reached that milestone compared with women, the gap has narrowed substantially since 1980.

Last year, 52% of men between 18 and 29 were financially autonomous, down from 63% in 1980. Young men without a college degree, in particular, are struggling. This group is most likely to live with their parents and suffer from stagnant wages and unemployment since the Great Recession, the study said.

Young women, however, are showing gains in financial independence, demonstrating the strides they’ve made in higher education and employment. In 2018, 42% of women between 18 and 29 were considered financially independent, up from 38% in 1980.

The study noted that more women between 25 and 29 have bachelor’s degrees or higher compared with men of the same age. The median earnings of women, while lower overall than men, increased 36% since 1980. Men’s wages grew only 1.3% in that same time.

Women also have nearly closed the employment gap. Last year, 65% of young women had jobs, up from 59% in 1980. That compares with 69% of men last year, down from 75% in 1980.

Read more in our Family section

Read more personal finance information, news, and tips on Cashay